1 Mar 2024 | Written by Pang Chun Enn

Outlook for the Rental Market - Mar 2024

Be it landlords, tenants or housing agents, I believe all parties can feel that there is a shift in the dynamics of the residential rental market. Many may wonder what has happened that caused the market shift. In this blog, we will go into what has caused the unsustainable rise during COVID, why is the current market dipping, and what are some actionable steps for landlords to take.

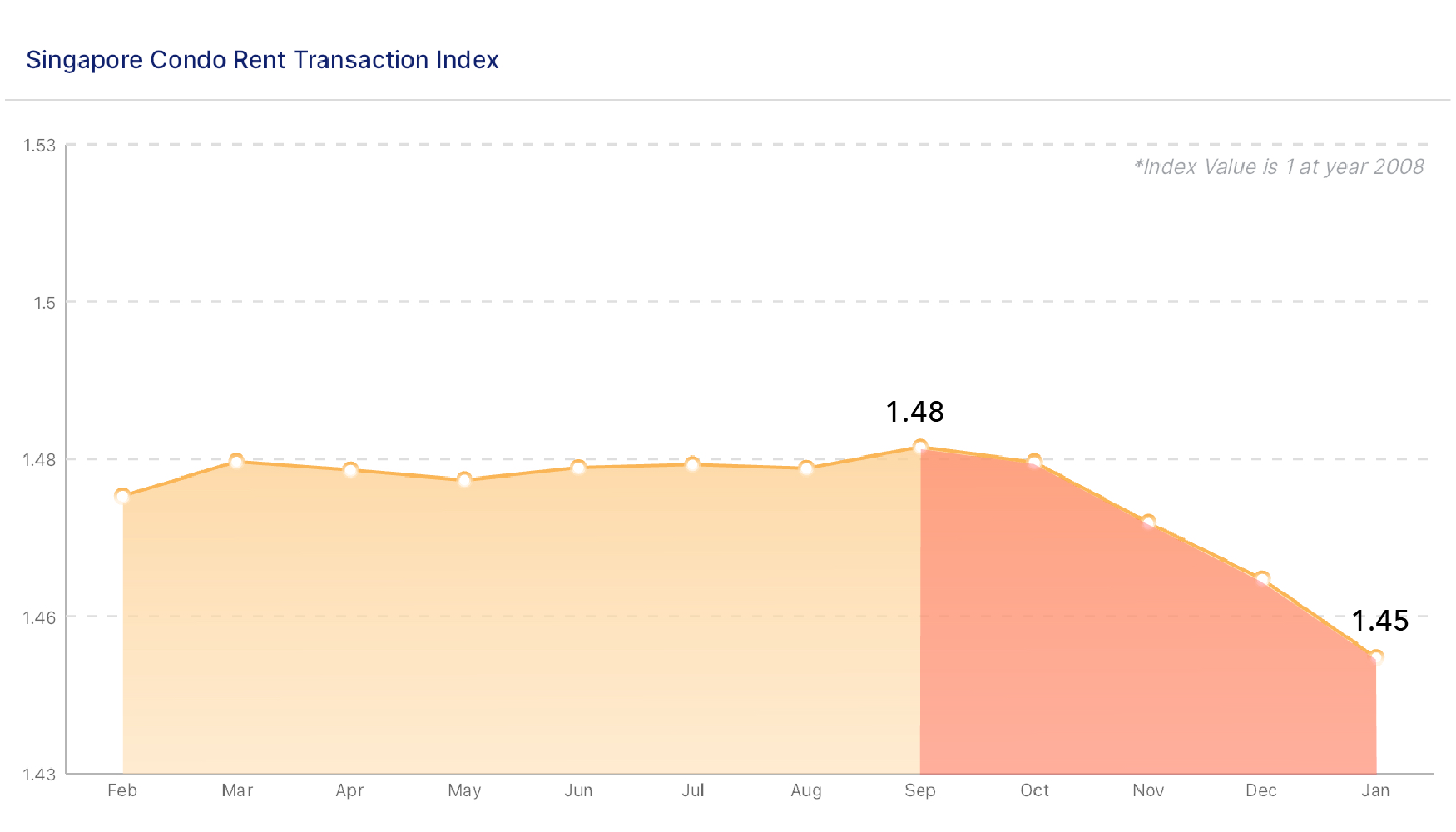

Before we being, let me share with you the rental index from Feb 2023 to Jan 2024 of both Private Condominiums and HDBs.

Fig 1.1 | Singapore Condominium Rental Index

Source: Soreal

Fig 1.2 | Singapore HDB Rental Index

Source: Soreal

As seen in Fig 1.1, the condominium rental index has declined for five months, from September 2023 to January 2024. As for the HDB rental index, it has been increasing subtly but still lower than an all-time high in July 2023.

2024 will possibly be the start of a year of stabilisation for residential rental prices due to the crazy rise in rental prices after COVID-19. There are many factors as to why the rental market is taking a hit now, but before we dive into that, let us understand what happened in the market from 2021 to 2022.

The unsustainable rise of residential rental

1 | Halt of Construction for BTOs and Private Properties

Back in 2020 and 2021 when Singapore went into a nationwide lockdown, all BTOs and residential private properties construction came to a halt. This caused a large backlog of units that were supposed to be completed. Due to this black swan event, some families could have possibly started family planning and required larger spaces for themselves. Since there was no additional supply of units at all and young couples/families needed spaces for growth, there was an increased demand for rental.

2 | Large influx of Foreign Workers/Expats in 2022

Once the COVID-19 situation got better, Singapore started to open their borders and ease community measures in early 2022. This indicates that the government has initiated the allowance for expatriates and foreign workers to enter Singapore and contribute to the economy's swift recovery. Yet, this move has generated a significant demand for rental units, resulting in a tightening of the rental market and subsequent price increases. The data can be retrieved from Singapore’s Population Government’s articles.

“The non-resident population increased by 6.6% from June 2021 to June 2022 to 1.56 million, but was still lower than the pre-COVID level of 1.68 million in June 2019. The bulk of the increase came from Work Permit Holders in the Construction, Marine Shipyard, and Process (CMP) sectors, as a result of the easing of travel restrictions related to COVID-19.”

While construction started to resume and most projects are yet to be completed, there was still a low additional supply of units for rent.

Ancedote

Back in 2022, my realtor colleagues and I were able to seal the deal for our landlords quickly. During the first viewing, there will be easily 8 to 10 groups viewing the unit. Offers will come awhile after the viewing, either matching the listed price or even higher.

On the other hand, it was so competitive that tenants began to pay agents who were representing them to secure a unit ASAP. Based on my experience, to help tenants secure a unit, we had to quickly convince them to either match the listed price, or possibly even higher to prevent a bidding war from happening.

So, why is the rental market dipping now?

1 | Huge quantity of units completed

There is a huge amount of units that were completed in 2022 and 2023, causing the rental market to have a huge influx of units available for rent.

Fig 2.1 | Amount of Private Residential Units Completed without EC

Source: URA Quarterly Report

In 2021, a modest 6,155 units reached completion, signalling a steady yet manageable pace of development after COVID-19. Fast forward to 2022, and we witnessed an increase, with 9,003 units added to the inventory. Then in 2024, there was a substantial increase of over 19,390 units reaching completion, and the market found itself with an abundance of available properties, significantly shifting the supply-demand equation in favour of tenants.

With more options available, tenants gain leverage when it comes to offering. Driving landlords to compete for occupancy by accepting lower rates.

2 | Impending expiration of signed leases

The prevailing practice in residential leasing involves signing agreements for two years, a choice that proves advantageous for both landlords and tenants. Hence, a significant portion of units rented out in 2020 or 2021 are reaching the end of their contracts. This influx of expiring leases adds to the pool of available rental units, intensifying competition among landlords for tenants.

In addition to lease expirations, local tenants who rented properties in 2020 and 2021 did so as a temporary measure while awaiting the completion of their new launch condominiums/BTOs. As we transition into 2023 and 2024, these tenants may choose to inconvenience their in-laws or explore other temporary living arrangements rather than engage in the rental market again.

3 | Economic Downturns and Increased Retrenchments

Another significant factor contributing to the dip in the rental market is the prevailing economic landscape. In times of economic uncertainty and increased retrenchments, the effects are felt across various sectors, including the real estate market.

A surge in retrenchments often signifies a slowdown in economic growth and a decrease in consumer confidence. In such scenarios, businesses may scale back their operations and spending, resulting in a decline in the influx of expatriates and foreign workers. This, in turn, directly affects the demand for rental properties, particularly in areas with a high concentration of expatriate communities.

“With many businesses restructuring and re-organising their organisations, retrenchments in Singapore rose to 14,320 in 2023 from a record-low of 6,440 in 2022. ”

Quoted from https://shorturl.at/bPSY6

Tenants who are affected by retrenchments may then choose to exercise diplomatic clauses in their tenancy agreements, allowing them to terminate their leases prematurely without incurring substantial penalties. This trend further adds to the turnover of rental properties and contributes to the surplus of available units in the market.

Ultimately, landlords may face challenges in securing new tenants or even maintaining rental rates, as prospective tenants become more cautious with their spending and seek more affordable housing options.

Navigating the Dipping Rental Market for Landlords

Following the discussion of challenges in the residential rental market, here are proactive measures for landlords to navigate through this challenging period.

Flexible Lease Terms: Accept flexible lease terms to attract tenants, such as shorter lease durations. It is better to be occupied than vacant.

Competitive Pricing: Review and adjust rental rates to remain competitive in the market while ensuring they cover expenses and provide a reasonable return on investment

Diversify Tenant Pool: Explore diversifying your tenant pool by targeting different demographics or offering furnished or unfurnished units to appeal to a wider range of potential tenants.

Wrapping up…

Every market in the world has its ups and downs and market correction is bound to happen. While recent trends may present challenges for landlords, it is important to recognize that these adjustments are often necessary for long-term stability and sustainability.

To landlords facing this tough rental market, whether you're seeking guidance on pricing strategies, market trends, or negotiation tactics, a trusted real estate agent will be able to offer support and expertise to help you navigate through this challenging period with confidence. Do not hesitate to reach out if you require any!

Pang Chun Enn

R065301I

Disclaimer:

The information provided in this blog is opinions and it is for informational purposes only. It should not be construed as professional advice. The views and opinions expressed are those of the author and do not necessarily reflect the official policy or position of any agency, organization, employer, or company. All content provided is intended to encourage discussion and exploration of topics related to the rental market. Readers are encouraged to conduct their own research and consult with relevant professionals before making any decisions. The author takes no responsibility for any actions taken based on the information provided in this blog.